Fueling the Future: How Ethanol Powers a Cleaner, Stronger America (Part 2)

A high-level guide to everything ethanol: what it is, how it works, and why it matters (continued)

Welcome to Part Two of our special edition newsletter on ethanol. In Part One, we laid the groundwork — the history of ethanol and the role ethanol already plays in today’s fuel system. In Part Two, we turn to the policies and programs shaping the future of the ethanol market, from the Renewable Fuel Standard and Low Carbon Fuel Standards to Section 45Z and the global market landscape. These systems determine whether ethanol scales up, stalls out, or gets left behind. If Part One was the context, Part Two is the call to action.

Too long, didn’t read:

The Renewable Fuel Standard (RFS) built a powerful market mechanism that linked carbon reduction to real economic value, but it’s overdue for a reset.

Low Carbon Fuel Standards (LCFS) are spreading beyond California, and how these programs are structured will determine whether ethanol thrives or gets sidelined.

Section 45Z is a game-changing opportunity to reward low-carbon ethanol, but realizing its full value depends on carbon capture, farm practices, and readiness across the supply chain.

The Renewable Fuel Standard: A Vision Ahead of Its Time

When Congress created the Renewable Fuel Standard (RFS), it didn’t just mandate blending targets — it created an entire market ecosystem designed to reward innovation and environmental performance. At the center of that system are three interlocking components: fuel pathways, Renewable Identification Numbers (RINs), and Renewable Volume Obligations (RVOs).

Pathways are where it all begins. To qualify as a renewable fuel under the RFS, a producer must operate within an EPA-approved fuel pathway — a specific combination of feedstock, production technology, and fuel type that meets greenhouse gas (GHG) reduction thresholds compared to baseline petroleum. If a producer installs new technology that reduces their emissions, or if they want to use novel feedstocks, they have to petition EPA to approve a new pathway. Without pathway approval, even the cleanest fuel can’t generate RINs. (Pathway applications are incredibly complex, technical, political, and time-consuming processes, and no two are alike. Yours truly has been involved in more of them perhaps than anyone alive. For those considering such an undertaking, find someone with experience to help guide you and get ready for a bumpy process unlike any you’ve ever been part of.)

RINs are the mechanism that moves the market. Every gallon of renewable fuel that meets an approved pathway generates a RIN, which is a unique tracking number that refiners and importers use to demonstrate compliance with the RFS. RINs are tradable commodities: refiners who can’t or won’t blend enough renewable fuel must purchase RINs on the open market to meet their obligations. That means producers creating cleaner, more valuable fuels not only earn revenue from selling gallons, they also capture additional value from the RINs associated with those gallons.

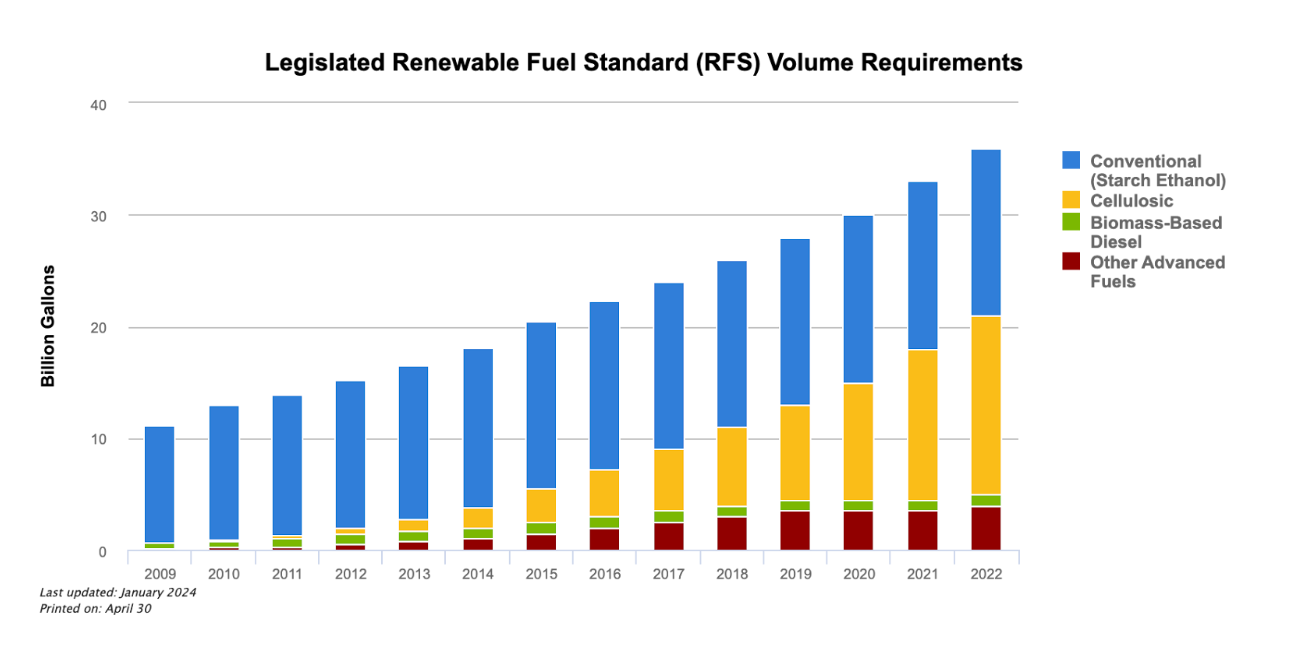

RVOs, or Renewable Volume Obligations, are the pressure points that keep the system moving. Each year, EPA sets the RVOs that define how much renewable fuel must be blended into the fuel supply. (Remember, Congress included an original vision for blending levels in the RFS2, but EPA sets yearly targets based on fuel market factors.) These targets create the demand that drives RIN generation and trading. Higher RVOs increase demand for blending and RINs; lower RVOs loosen the market. The balance between RIN supply, blending capacity, and RVO requirements determines the value of RINs and the health of the renewable fuel market overall.

This architecture of pathways creating eligibility, RINs creating value, and RVOs creating demand was a true policy innovation. It didn’t rely on direct subsidies or government handouts. Instead, it used market forces to drive continuous investment in cleaner fuels.

One of the smartest features of the system was how it was designed to accelerate the next generation of renewable fuels. RINs for advanced and cellulosic biofuels were intended to be worth much more than conventional ethanol RINs, creating a powerful financial incentive to develop and scale up technologies like cellulosic ethanol, algae fuels, and other low-carbon innovations.

For a while, RFS2 worked exactly as intended. But post-Great Recession gasoline demand not recovering and the subsequent development of the Blend Wall were Black Swans nobody saw coming. The wave of SREs and lawsuits that flowed from this friction combined with soft RVOs destabilized the RIN market, discouraged investment in advanced biofuels, and triggered a cascade of political fallout. At the same time, the promise of using high-value RINs to accelerate advanced fuel development began to fade. Compliance pressure was consumed by conventional blending struggles. And the opportunity to scale next-generation technologies through strong advanced fuel markets never fully materialized. Annual ethanol blending levels sometimes fail to meet the relatively soft RVOs that are set, despite ethanol production capacity being well in excess of these targets. This situation is a prime example of the impact of the regulatory uncertainty that reigns supreme in today’s ethanol market.

Despite these challenges, ethanol producers continued innovating. They invested in efficiency, carbon capture, and advanced technologies. To truly unlock ethanol’s full potential and make the RFS work as intended, higher blends like E15, E20, and even E30 must become widespread. The technology exists. The infrastructure is catching up. What’s missing is regulatory certainty and a market structure that supports scaling beyond E10.

In the end, the architecture was brilliant. But the system collided with economic forces that no one had fully anticipated. Today, the RFS still provides the backbone of support for America’s ethanol industry, but its full potential to rapidly scale low-carbon innovation remains, in many ways, unfinished business.

The Low Carbon Fuel Standard: The First Real Carbon Market

A Low Carbon Fuel Standard (LCFS) is a market-based policy designed to gradually reduce the carbon intensity of transportation fuels. Unlike mandates that require specific volumes or ban certain fuels, LCFS programs work by setting an annual carbon intensity benchmark that declines over time. Fuels that fall below this benchmark generate credits. Fuels that exceed it generate deficits. Obligated parties — typically fuel refiners and importers — must balance their performance by either blending or selling cleaner fuels, purchasing credits, or both. The result is a flexible framework that allows the market to determine the most cost-effective way to cut emissions, while encouraging innovation across all fuel types.

California launched the first LCFS in 2011 under the direction of the California Air Resources Board (CARB). The program was designed to reduce the carbon intensity of transportation fuels by 10% by 2020, using 2010 as a baseline. From the beginning, California’s approach stood out because it focused on lifecycle greenhouse gas emissions, rather than prescribing or banning specific fuels. Ethanol, biodiesel, renewable diesel, and electricity were all eligible to compete — so long as they could prove their carbon intensity was low enough. This performance-based structure allowed a broad mix of technologies to flourish, and positioned California as a global leader in transportation carbon policy.

Today, California’s LCFS is among the most comprehensive and technically complex carbon markets in the world. It now targets a 20% carbon intensity reduction by 2030, and in 2023 alone, more than 17 million LCFS credits were generated across a wide range of fuels. Ethanol remains a significant contributor, especially from Midwest producers using low-CI technologies like cogeneration and recycled process heat. These fuels not only generate credits for themselves, but help obligated parties — like refiners — meet their compliance obligations. Credit prices have ranged from $75 to over $200 per metric ton of CO₂e over the last few years, creating strong market signals and tangible value for low-carbon fuels.

In late 2024, CARB proposed a major amendment to the LCFS that would significantly tighten the program. The update would increase the 2030 carbon intensity reduction target from 20% to 30%, introduce a one-time 5% benchmark drop in 2025, and set a long-term goal of a 90% reduction by 2045. It also proposed an “Automatic Acceleration Mechanism” to tighten future targets if progress stalls, and introduced new restrictions on crop-based feedstocks, including third-party sustainability certification and land use protections. However, in early 2025, California’s Office of Administrative Law (OAL) disapproved the proposal, citing issues with regulatory clarity, temporarily delaying implementation of the amendments. This is not to say that the amendments won’t be put in place. CARB is currently making updates to the amendments to satisfy OAL the amendments will likely move forward.

At the same time, California politics are increasingly dominated by a drive to electrify the entire transportation sector. The state’s regulatory agencies, including CARB, are prioritizing electric vehicle deployment to such an extent that they risk overlooking — or actively excluding — low-carbon liquid fuels like ethanol. Ethanol producers, despite offering measurable and immediate carbon reductions, are seeing fewer opportunities to participate in the state’s long-term climate strategy. In some cases, new rules appear structured to limit the role of biofuels simply because they’re not electric. This is a critical policy tension: while EVs are essential to long-term decarbonization, ethanol can deliver substantial GHG reductions now. Sidelining these solutions because they don’t align with a single technology path risks slowing overall progress toward emissions goals.

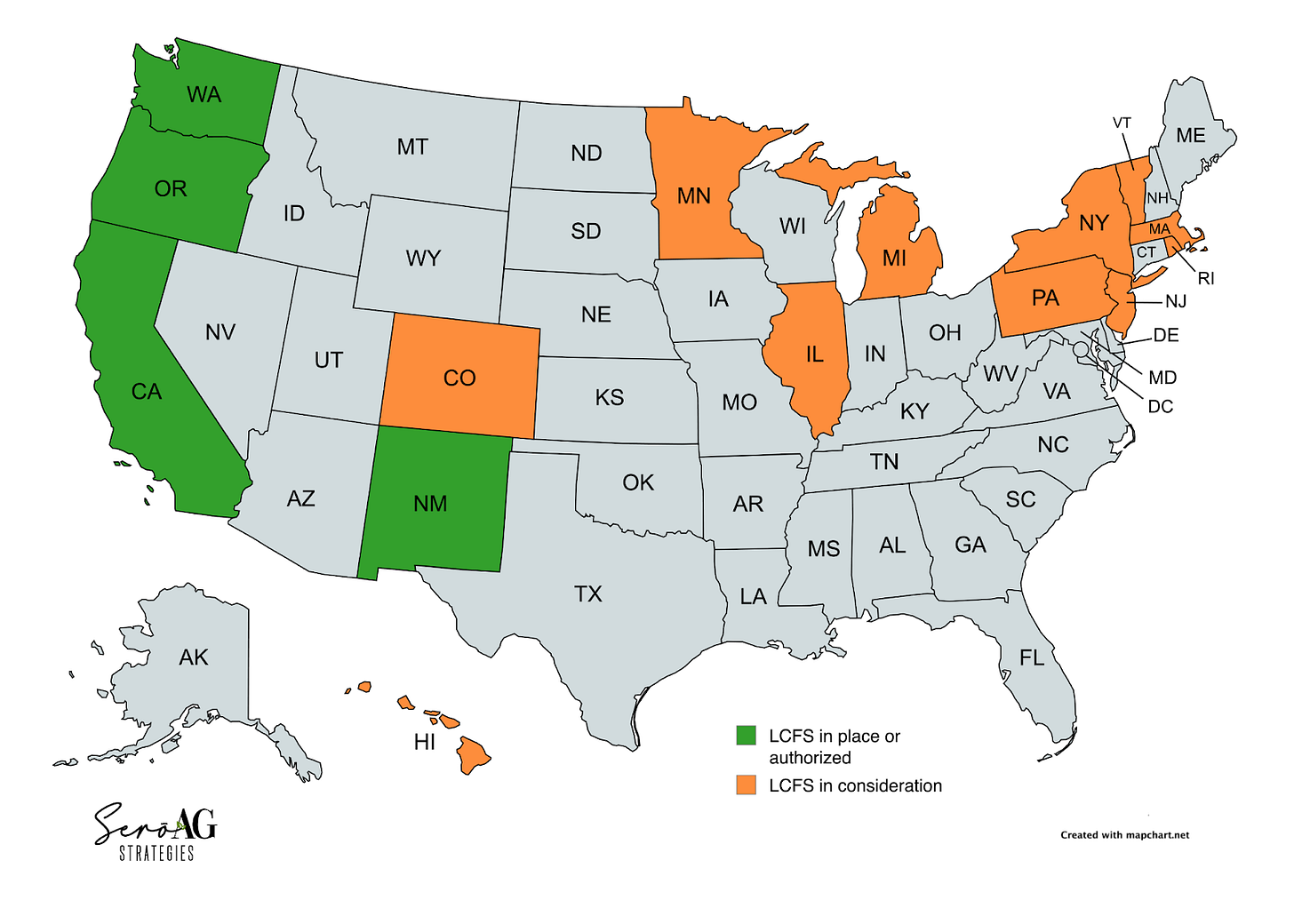

California’s LCFS has become the blueprint for similar programs around the country — and even internationally. Oregon and Washington have implemented nearly identical clean fuels programs, and Canada’s Clean Fuel Regulations were modeled in part on California’s experience. British Columbia has maintained a provincial LCFS since 2010. In the U.S., several additional states are moving toward their own standards. New York has introduced LCFS legislation in multiple sessions, and New Mexico has authorized a Clean Transportation Fuel Program. Meanwhile numerous states across the country are in early discussions about clean fuel standards. As these programs proliferate, the structure, pace, and priorities set by California’s LCFS will influence national carbon markets for years to come.

For ethanol, the path forward in LCFS programs hinges on one thing: performance-based policy. So long as lifecycle carbon reductions remain the currency of compliance, and so long as fuels are rewarded for real emissions savings regardless of their form, ethanol can and will continue to compete. But if future LCFS programs begin to mirror California’s political bias toward electrification at all costs, they risk leaving behind powerful, proven solutions.

Creating Global Demand

The U.S. Grains Council (USGC) continues to lead the charge in expanding global markets for U.S. ethanol, positioning it as a key solution for countries aiming to lower carbon emissions and boost energy security. The Council is driving initiatives that support ethanol blending targets — most notably in Japan, which plans to reach a 20% ethanol blend in gasoline by 2040. These efforts underscore ethanol’s value not only as a renewable fuel but also as a vital component across industries such as chemicals, pharmaceuticals, and cosmetics.

But the global conversation isn’t limited to ethanol. Distillers Dried Grains with Solubles (DDGS), a nutrient-rich co-product of ethanol production, is emerging as a high-demand animal feed ingredient. The DDGS market is projected to nearly double in value by 2034, driven by rising global demand for sustainable, high-protein feed. The U.S. remains a dominant supplier, and countries like Brazil are ramping up production to meet both domestic and export needs.

Despite the strong outlook, trade policies and geopolitical tensions continue to shape market dynamics. For example, tariffs on Mexican imports could have ripple effects on DDGS exports, as Mexico has long been one of the largest buyers. Navigating these uncertainties will require ongoing engagement and adaptation. With its proactive global strategy, the USGC remains a cornerstone in both promoting U.S. agricultural products and shaping the future of clean energy and sustainable feed.

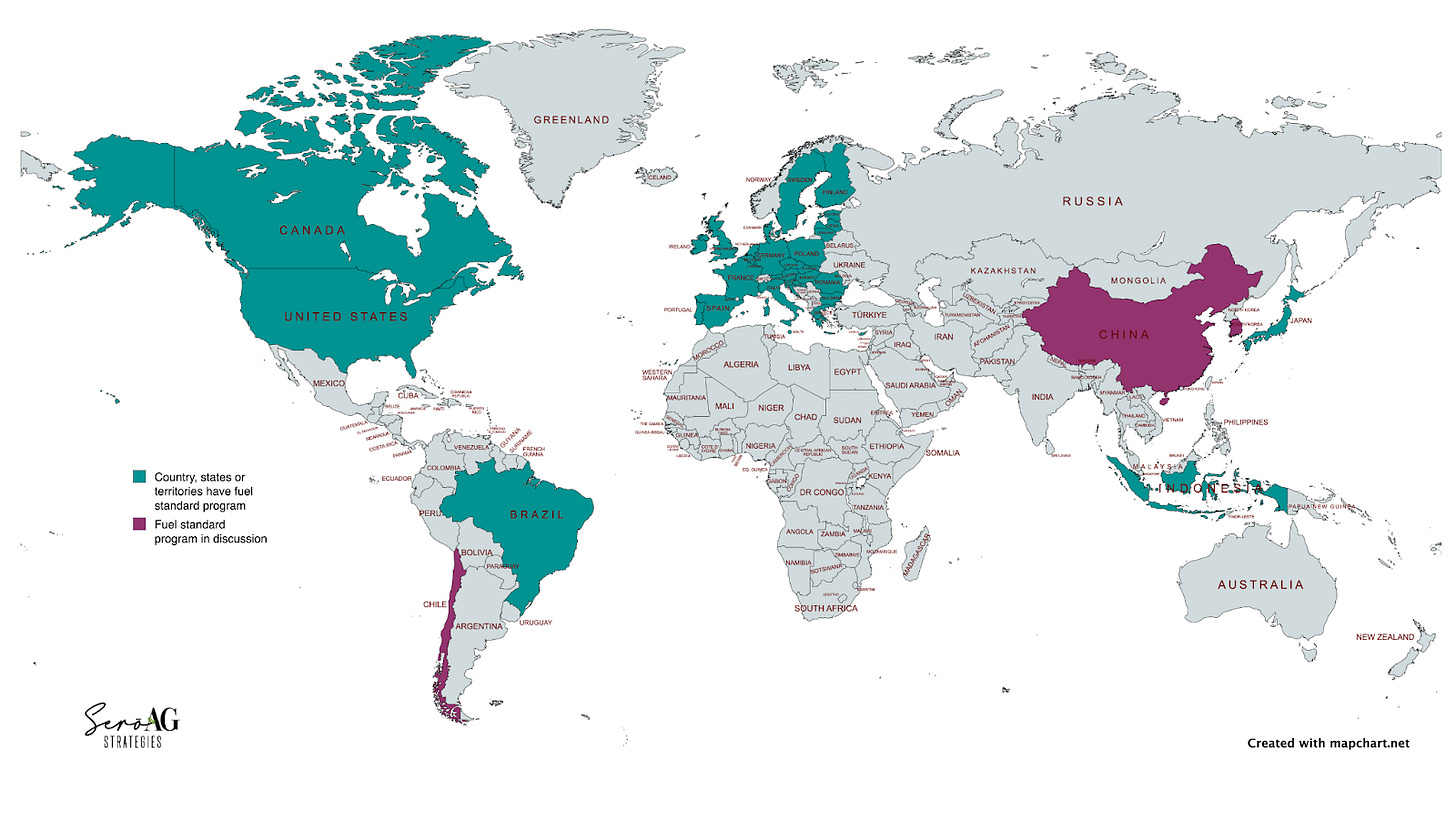

On the sustainability front, Canada recently implemented its Clean Fuel Regulations (CFR), a major policy aimed at reducing the carbon intensity of transportation fuels by 15% by 2030. The CFR mirrors many aspects of California’s LCFS, establishing a lifecycle carbon reduction framework that rewards lower-carbon fuels like ethanol. American ethanol, with its demonstrated carbon reductions and robust supply chain, is perfectly positioned to meet a substantial portion of this new demand.

In Europe, the Renewable Energy Directive (RED II and III) has established a framework for renewable fuels to play a major role in achieving ambitious climate targets. First adopted by the European Union in 2009, RED established binding targets for renewable energy use across member states, including a 10% renewable energy requirement for the transportation sector by 2020. RED introduced strict sustainability and lifecycle greenhouse gas (GHG) reduction criteria for biofuels entering the EU market.

Under RED II, implemented in 2021, these requirements tightened: biofuels must achieve at least a 50% GHG savings compared to fossil fuels (rising to 65% for new facilities) and meet strict land use and traceability rules. For U.S. ethanol producers, RED represents both an opportunity and a challenge. Accessing the European market requires compliance with RED sustainability standards, including detailed lifecycle carbon accounting and proof that feedstocks were grown without contributing to deforestation or land use change. For producers who can meet these benchmarks — particularly those investing in low-CI practices and traceable supply chains — Europe remains a valuable, premium outlet for U.S. ethanol exports. But compliance costs and paperwork burdens can be significant.

The International Sustainability and Carbon Certification (ISCC) system emerged in 2010 as a global certification standard designed to verify compliance with programs like RED and other voluntary sustainability frameworks. ISCC certification covers the full supply chain, from agricultural feedstock production to final fuel processing, and focuses on criteria like GHG savings, land use, biodiversity protection, and social responsibility. For U.S. ethanol producers, ISCC certification has become the de facto passport for international trade into regulated low-carbon fuel markets, not just in Europe, but also in emerging markets in Asia and South America. Ethanol producers certified under ISCC can more easily demonstrate RED compliance and qualify for premium pricing in jurisdictions that recognize ISCC standards. However, certification requires rigorous data collection, supply chain transparency, and regular audits, adding both operational complexity and cost. Still, for many U.S. ethanol exporters, ISCC certification has become a critical part of their global market strategy.

Although European politics often lean heavily toward electrification, ethanol remains an important compliance tool under RED. Several EU member states, such as France, Germany, Spain, and The Netherlands have implemented their own national biofuel blending mandates that exceed the baseline RED requirements. Meanwhile, the UK, post-Brexit, has established its own Renewable Transport Fuel Obligation (RTFO), which includes both volume targets and carbon intensity metrics with ethanol serving as a key compliance option.

To the south, Brazil, one of the world’s ethanol powerhouses, continues to expand its RenovaBio program, which creates tradable decarbonization credits (CBIOs) for low-carbon fuel producers. RenovaBio has significantly strengthened Brazil’s ethanol market and is creating a blueprint for carbon intensity-based programs in emerging markets. Other nations, including Japan, Colombia, and China, have either established national ethanol blending mandates or are actively pursuing them as part of broader clean energy strategies. In total, more than 36 countries today have formal clean fuel blending targets — some with sharp teeth and others more aspirational, creating a strong foundation for continued global growth.

Section 45Z: Ethanol’s Biggest Opportunity Since RFS2

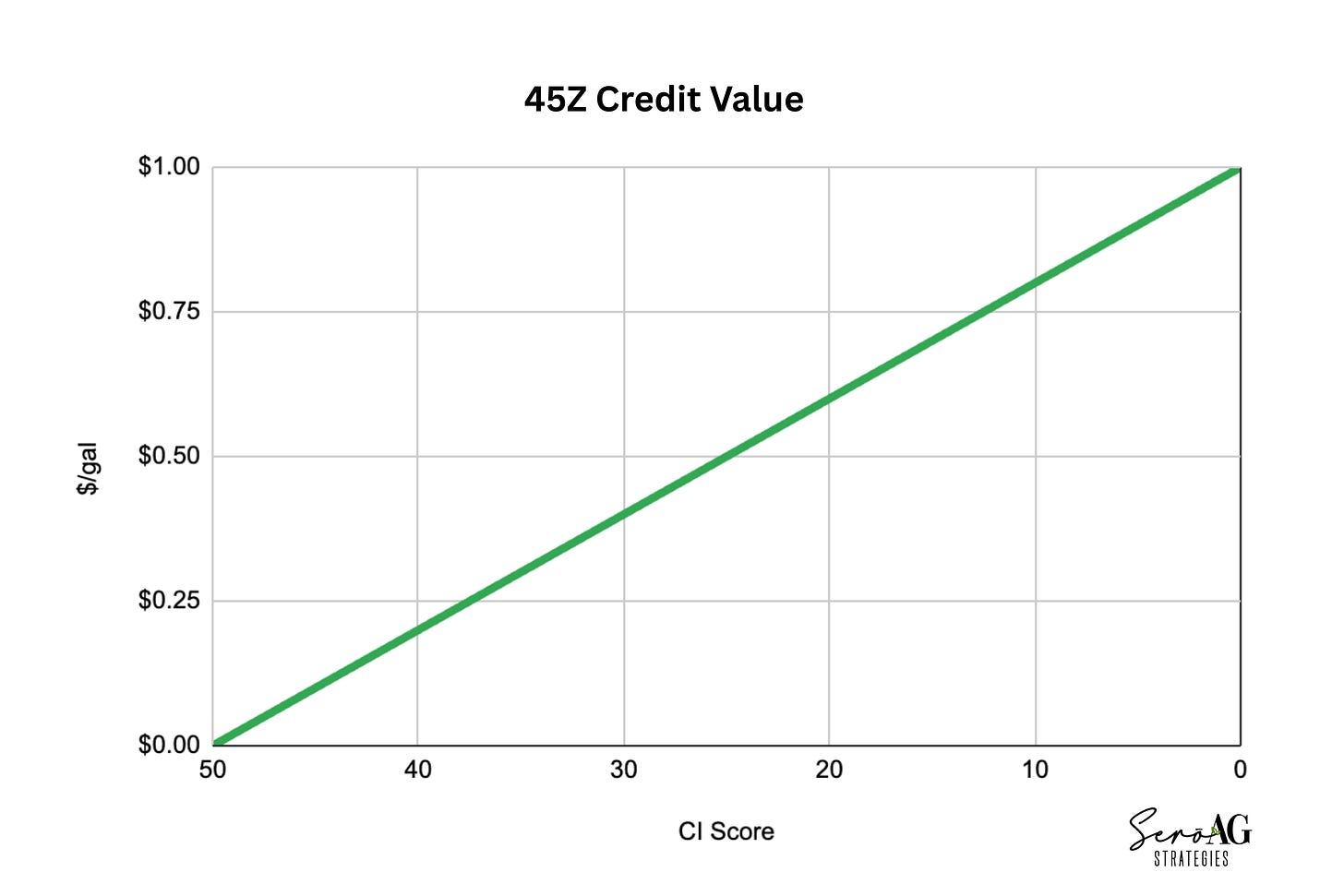

In 2022, Congress passed the Inflation Reduction Act, one of the most significant pieces of clean energy legislation in American history. Embedded within it was Section 45Z, the Clean Fuel Production Credit — and for ethanol, it may be the most transformational opportunity since the passage of RFS2 nearly two decades ago. Unlike the RFS, which mandates blending volumes, 45Z directly rewards carbon intensity reduction. Beginning in 2025, fuel producers will earn a production tax credit based entirely on how much they can lower the carbon intensity (CI) of their fuel relative to a baseline. Ethanol plants with lower CI scores will receive higher credits, with values scaling up to a $1 per gallon for the cleanest fuels.

The U.S. Department of Agriculture’s newly released Feedstock Carbon Intensity Calculator (FD-CIC) will standardize how low-carbon farm practices are recognized, ensuring that sustainable agriculture becomes an integral part of the biofuels value chain. For ethanol, this creates an unprecedented opportunity: To extend value creation beyond the biorefinery and into the fields themselves, and to turn America’s farmers into direct participants in the low-carbon fuel economy.

Perhaps the most immediate lever to unlock value under 45Z is carbon capture and storage (CCS). Facilities that invest in CO₂ capture, transportation, and sequestration can dramatically reduce their carbon intensity scores — and dramatically increase their 45Z credit value. Proposed Midwest CO₂ pipelines that are designed to aggregate carbon from multiple ethanol plants and permanently store it underground have faced delays due to lawsuits, permitting battles, and local opposition. Where will these fights land? It’s anybody’s guess today, but without CCS, many ethanol plants will leave tens of millions of dollars on the table annually once 45Z credits go live.

Section 45Z represents a new chapter for ethanol — one where carbon performance becomes the coin of the realm. It aligns perfectly with ethanol’s strengths: existing infrastructure, measurable decarbonization, rural economic benefits, and the ability to scale improvements rapidly. It also reaffirms a core truth that policymakers, investors, and environmentalists are increasingly recognizing: Carbon markets based on real products and real emission reductions, like ethanol through LCFS and 45Z, are far superior as compared to speculative offset schemes.

As 45Z takes effect, the plants, farmers and companies that move first will lead the next era of American clean energy innovation, and ethanol will once again prove that the future is being built in America’s fields and biorefineries.

Conclusion

In a world that too often chases future technologies at the expense of practical solutions, ethanol stands apart. It is not a science experiment, a pilot project, or an unfunded mandate. Ethanol is real. It is ready. It is delivering cleaner fuels, stronger rural economies, and real greenhouse gas reductions today — at scale.

From its early days in Midwest barnyards to its central role in today’s low-carbon fuel standards, ethanol has proven again and again that American innovation can solve the world’s toughest problems. Ethanol created the first real carbon market. Ethanol brought measurable, verifiable decarbonization to the transportation sector. Ethanol saves drivers billions at the pump and revitalizes communities across rural America. Now, with transformational policies like E15 expansion, 45Z, and the growth of low carbon fuel standards at home and abroad, ethanol is poised to drive the next wave of clean energy leadership. Not in ten years. Not someday. Now.

The challenges ahead — from global climate change to national energy security — demand real action, not slogans. Ethanol is action. It is working today. It is improving every year. And it is ready to do even more. For policymakers, for consumers, for investors, for farmers — the message is simple:

If you want cleaner energy, stronger economies, and faster results, ethanol is the answer.

Recent Articles

Advanced tech moves sorghum into the future in Kansas Farmer

Beyond exports: How ethanol keeps sorghum farmers thriving in uncertain times in Kansas Farmer

If you haven’t already, check out our previous newsletters.

About Serō Ag Strategies

At Serō Ag Strategies, we bridge farmers and supply chain partners by transforming complex agricultural data and policy into actionable insights. We also work to create and grow markets for commodity crops by aligning production with evolving demand, policy shifts, and sustainability goals. Combining multinational expertise with the personal touch of boutique consulting, we specialize in economic and sustainability analysis that drives strategic innovation.

Click here to learn more about Serō Ag Strategies.